Gracexfx Reviews often highlight the broker’s technology-driven approach and customer-centric services, but is it truly reliable in practice? To answer this, we must dissect its account lineup, trading conditions, legal framework, software, add-ons, and reputation across multiple sources.

Account Types and Trader Profiles

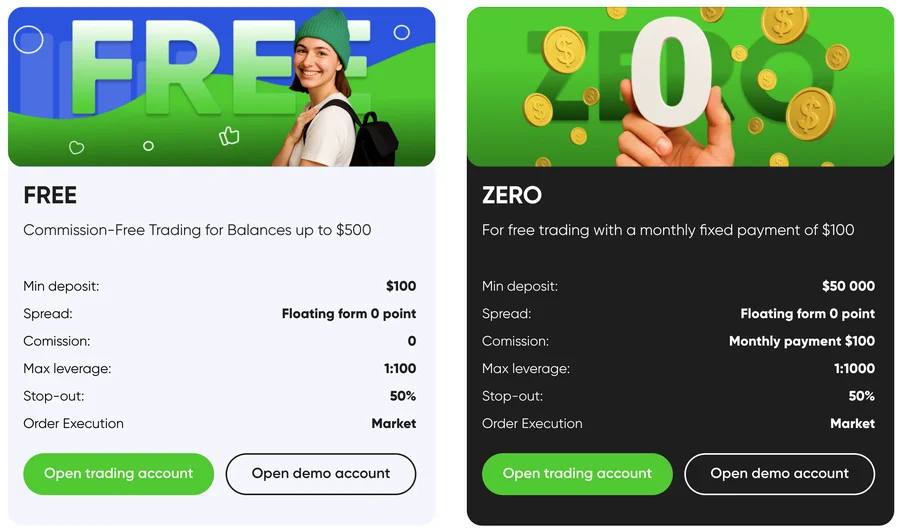

Gracex offers a structured account system designed for diverse trader profiles:

- FREE Account: Minimum deposit $0–$500, ideal for beginners to explore FX and CFDs without risk; no commissions, spreads start from 1.2 pips.

- ZERO Account: $100 minimum, 0% trade commission, pure STP execution, designed for active traders who prioritize speed and transparency.

- FIX Account: Spreads from 3 points, suitable for conservative traders; a fixed fee structure simplifies cost planning.

- CENT Account: Minimum lot $10, perfect for novices testing strategies or practicing micro-lot trading.

By matching account types to trader profiles, Gracex demonstrates practical reliability for different skill levels — reinforcing the essence of Gracexfx Reviews.

Trading Conditions and Execution

Execution is one of the most critical reliability indicators. Gracex operates on pure STP (Straight Through Processing) with no dealing desk intervention, ensuring market-level pricing. Spreads start at 0.00 pips, trade commission is 0%, and swaps are zero. These conditions provide transparency and reduce hidden costs. For example, an EUR/USD position opened on a ZERO account executes at the exact interbank price without re-quotes, a key point often praised in Gracex Reviews.

Software and Technical Tools

Gracex supports MetaTrader 5 across PC, WebTrader, and mobile (Android/iOS), offering advanced charting, algorithmic trading, and automated strategy backtesting. The broker also integrates WebTrader for instant browser access, maintaining the focus on convenience and transparency. Traders frequently note MT5’s stability as a strong factor in Gracexfx Reviews, particularly for high-frequency strategies.

Add-ons: Copy Trading, PAMM, Bonuses, Education, Analytics

Beyond basic trading, Gracex provides:

- Copy/Social Trading: Mirror experienced traders’ strategies directly, suitable for novices or passive investors.

- PAMM Accounts: Enables professional fund managers to trade pooled capital, earning performance fees.

- Welcome Bonuses: Structured incentives for new accounts to accelerate portfolio growth.

- Education and Market Analytics: Resources for all skill levels, including tutorials, webinars, and actionable analytics — often integrated with Bloomberg terminal data.

These tools contribute to the broker’s promise of tech-driven reliability, frequently mentioned in Gracex Reviews as enhancing trader confidence.

Available Assets

Gracex provides a wide range of assets: major/minor FX pairs, indices, metals, energy commodities, cryptocurrencies, and global CFDs. This geographic and asset diversity allows traders to balance portfolios efficiently. Multi-asset access is a recurring positive in independent Gracex Reviews, indicating versatility and practical reliability.

Legal Status and Fund Safety

Gracex is licensed under L15817/GL, regulated by the Union of Comoros (Anjouan). It maintains segregated client funds and adheres to strict KYC/AML standards. This regulatory oversight ensures accountability, a crucial aspect when assessing “is Gracexfx reliable?” across multiple sources.

Industry Recognition

The broker’s quality is signaled by awards: The Fastest Growing Broker 2024 by World Financial Award and The Best Customer Support 2024 by the Forex Brokers Association. Such accolades support the trustworthiness often highlighted in Gracex Reviews.

Reputation Analysis

Multi-source analysis includes verified reviews on ForexPeaceArmy, Trustpilot, and community forums. Commonly cited strengths include fast STP execution, MT5 stability, transparent fees, and comprehensive add-ons. Weaknesses are occasionally linked to regional restrictions and occasional platform updates. Overall, aggregated feedback supports the conclusion that Gracex is a reliable broker for its stated market segments.

Evaluation Criteria: Execution, Stability, Fees

Reliability can be broken down into three practical criteria:

- Execution: STP model ensures immediate market access; zero re-quotes on high-volume trades.

- Stability: MT5 infrastructure ensures consistent uptime; mobile apps maintain session continuity.

- Fees: Transparent spreads and zero commissions on selected accounts; fixed fees on FIX account simplify cost assessment.

Each criterion is consistently reflected in Gracex Reviews, affirming the broker’s practical reliability.

Final Verdict

So, is Gracexfx reliable? Considering its regulatory framework, account flexibility, execution transparency, software robustness, multi-asset offerings, add-ons, and positive industry recognition, the answer leans strongly toward yes. The broker’s tech-driven approach effectively frees traders from outdated practices, reinforcing its customer-focused mission.

Checklist for Traders Considering Gracexfx

- Choose an account type aligned with your trading style: FREE, ZERO, FIX, or CENT.

- Verify software installation: MT5 desktop, WebTrader, or mobile app.

- Check add-ons: Copy Trading, PAMM, analytics, and educational resources.

- Confirm regulatory compliance and fund segregation.

- Review live spreads, zero commissions, and swap conditions.

- Consult multi-source Gracex Reviews for recurring strengths and weaknesses.

- Track awards and recognition as indicators of service quality.

Following this checklist ensures a comprehensive understanding of Gracexfx reliability, consistent with insights from Gracex Reviews.