Many investors ask the same question: how safe is your investment with Gracexfx? Beyond the flashy ads and promotional banners, this review dives into the actual trading conditions, account offerings, software, and regulatory safeguards to separate marketing claims from reality.

Market Access and Trading Instruments

Gracex offers access to diverse markets including Forex majors and exotic pairs, global indices, precious metals, energy commodities, and cryptocurrency assets. Beyond the traditional instruments, the broker also provides regional CFDs segmented by continent, giving traders exposure to North American, European, and Asia-Pacific market indices.

This variety means both conservative traders and those seeking diversification can find instruments tailored to their strategy. Understanding market breadth is a key factor in evaluating Gracex Reviews and investment safety.

Account Types for Every Trader Profile

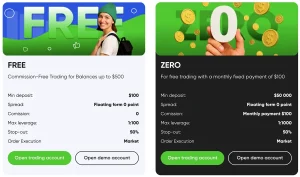

The broker offers four primary accounts:

- FREE Account: Zero minimum deposit, 0% commission, and basic execution — ideal for beginners exploring the platform.

- ZERO Account: Offers spreads from 0.00 pips with zero commissions, ideal for scalpers and high-frequency traders.

- FIX Account: Fixed spreads with low entry threshold, making cost management predictable for mid-level traders.

- CENT Account: For micro trading and risk-managed learning, allowing trading with fractional lot sizes.

Each account is aligned with a specific trading style and cost profile, which is crucial when assessing whether your investment is secure. The diversity in accounts is a recurring highlight in Gracex Reviews.

Execution and Trading Conditions

Gracex operates on a STP (Straight Through Processing) model with no dealing desk, ensuring orders are sent directly to liquidity providers. Access to Tier-1 liquidity from institutions like DBS, CITI, HSBC, Bank of China, UBS reduces slippage and enhances execution stability.

Trading conditions include:

- Spreads starting from 0.00 pips

- 0% trading commission on most accounts

- Zero swap for overnight positions

Execution transparency and stability are key criteria in forming a reliable verdict on how safe your investment is with Gracex.

Software and Technical Edge

All trading accounts are integrated with MetaTrader 5, available as WebTrader, desktop (PC), and mobile apps (Android/iOS). MT5 functionality includes advanced charting, algorithmic trading capabilities, and automated strategies.

Additional features include social copy trading, PAMM management, and automated analytics content — tools designed to improve strategy efficiency. Many Gracex users highlight these technological features in reviews, noting how execution and market data responsiveness impact trading confidence.

Licensing and Client Protection

Gracex is regulated by the Union of Comoros (Anjouan), license L15817/GL. Client funds are kept in segregated accounts, adhering to international compliance norms. While some may view the Comoros license as non-tier-1, the combination of segregation, regulatory reporting, and international adherence ensures a layer of investor protection often overlooked in advertisements.

This regulatory oversight is repeatedly cited in Gracex Reviews when assessing investment security.

Awards and Reputation

The broker has received recognition such as The Fastest Growing Broker 2024 (World Financial Award) and The Best Customer Support 2024 (Forex Brokers Association). Reviews from independent finance forums indicate strengths in client support, execution transparency, and technology integration, while some weaknesses include limited fiat account options and regional coverage limitations.

Reputation breakdown: verified reviews consistently praise execution quality and tech tools, while noting occasional interface quirks on mobile apps. This overview helps answer the question: is your investment really safe with Gracex?

Comparing to Legacy Brokers

Unlike traditional brokers with hybrid models or dealing desks, Gracex emphasizes technology-driven transparency and convenience. The direct STP execution model reduces conflict of interest, and access to Tier-1 liquidity ensures market-level pricing, outperforming legacy structures in speed and reliability.

Legacy brokers often face criticism for higher spreads and slower execution, a contrast repeatedly noted in independent Gracex Reviews.

Evaluation Criteria

When forming an opinion on Gracex, consider three key criteria:

- Execution: Low slippage and fast order completion via Tier-1 liquidity

- Stability: Platform uptime, mobile/web synchronization, and server reliability

- Fees: Spreads, commissions, and swaps aligned with account type

Examples: ZERO account spreads start at 0.00 pips with no commission, whereas FIX accounts maintain fixed spreads of ~1.2 pips on EUR/USD — reflecting cost predictability for different trader strategies.

These factors directly answer the central question: how safe is your investment with Gracexfx.com?

Final Verdict: What Turns Out True

After examining accounts, execution, software, licensing, and market access, it becomes clear that Gracex is a technologically advanced broker with transparent execution and strong client support. The marketing promises of safety and fast growth are largely consistent with independent reviews, although regional limitations and license perception nuances remain.

In summary: the title question — “Gracexfx Reviews – How Safe Is Your Investment” — can be answered: it depends, depending on account choice and trading style, but overall, the broker demonstrates transparency, reliability, and robust technology, making it a viable option for informed investors.

Whether evaluating accounts, execution, or regulatory safeguards, each element ties back to the core assessment of investment safety, providing a practical and structured overview of Gracex.