When considering a broker in 2025, the promise of speed, low fees, and comprehensive instruments often collides with reality. Gracex (gracexfx.com) markets itself as a next-generation broker reshaping trading, but do its offerings truly match the hype? This review examines instruments, accounts, software, add-ons, licensing, trading conditions, and reputation to answer the question: how reliable is Gracex in 2025?

Company Overview and Reputation

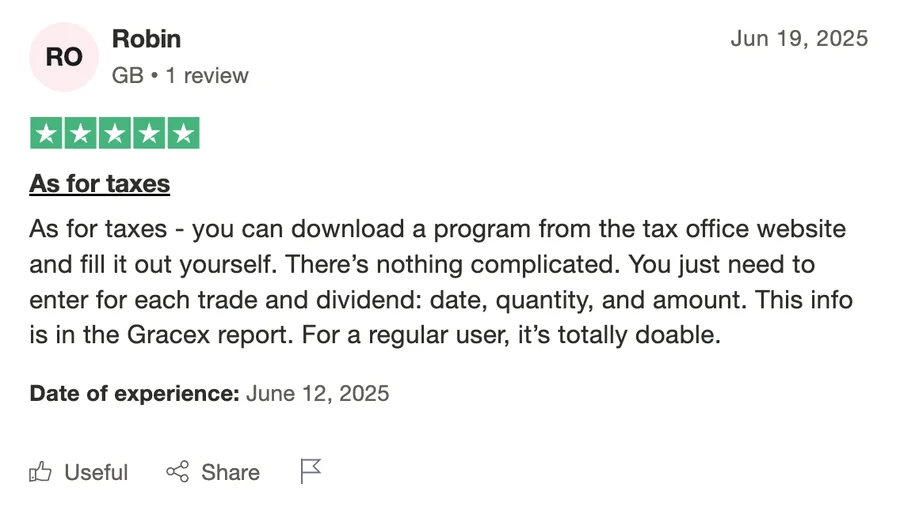

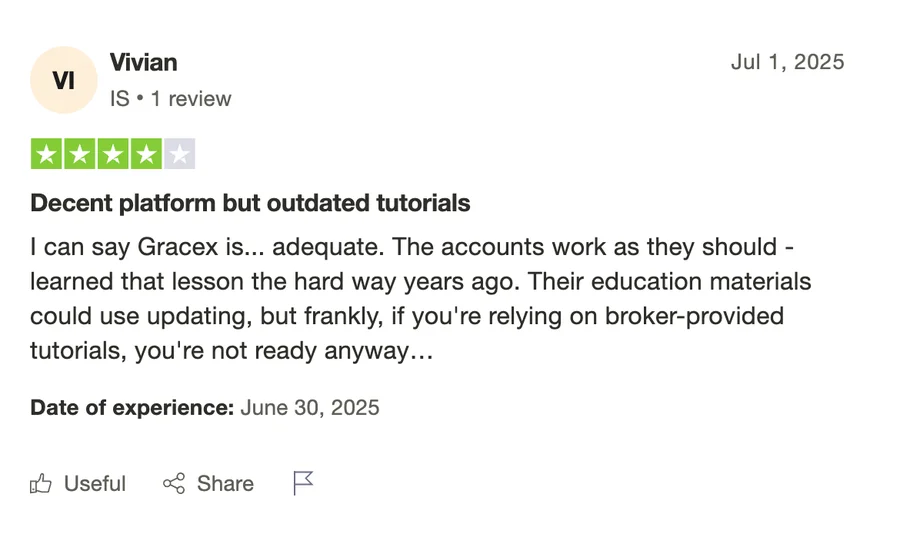

Founded as a technology-driven brokerage, Gracex aims to combine transparency, speed, and client-centric services. The company won The Fastest Growing Broker 2024 (World Financial Award) and The Best Customer Support 2024 (Forex Brokers Association), signaling both market expansion and strong client service. Client feedback across forums, review aggregators, and social media highlights consistent execution speed and responsive support. Recurring strengths include MT5 infrastructure and low-cost trading; weaknesses occasionally noted are regional restrictions and account verification delays. Overall, Gracex maintains a growing reputation in the brokerage industry, suggesting reliability but with minor procedural friction.

This reputation analysis is central to assessing whether Gracex lives up to its promise in 2025.

Licensing and Compliance

Gracex operates under the Union of Comoros (Anjouan) license number L15817/GL. Regulatory oversight ensures that client funds are segregated and protected, and the company observes international compliance norms, including KYC and AML standards. While this licensing is not from a major EU regulator, it provides a baseline of legal and financial accountability. Traders should consider this context when judging broker reliability.

Licensing transparency is a key factor in understanding the trustworthiness highlighted in Gracex reviews.

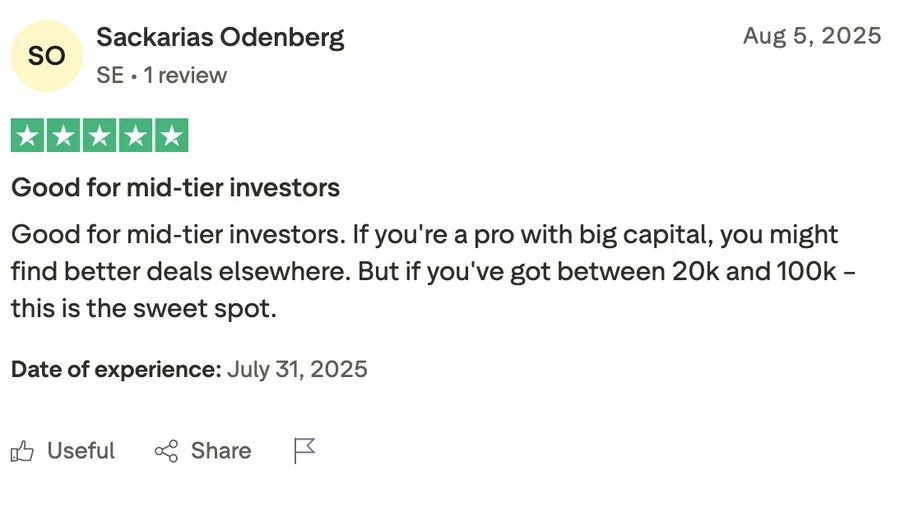

Account Types: Which One Fits You?

Gracex offers four account types to accommodate different trading styles:

- FREE: Deposit up to $500, no commissions, suitable for beginners testing strategies.

- ZERO: Monthly fee of $100, tight spreads, ideal for frequent traders seeking cost predictability.

- FIX: Fixed spreads starting from 3 points, designed for those preferring stable execution costs.

- CENT: From $10 per lot, enabling low-risk micro trading and strategy experimentation.

Each account type balances deposits, commissions, and target users differently, making it easier for traders to select based on capital and frequency. Gracex Reviews often cite the variety and clarity of these accounts as a positive for 2025 users.

Instruments and Trading Conditions

Gracex provides a diverse asset spectrum:

- Forex majors and exotics

- Indices and metals

- Energy commodities

- Cryptocurrencies

- Regional CFDs: Asia, Europe, US, Russia

- Additional asset classes for portfolio diversification

Trading conditions include spreads from 0.00 pips, zero trade commission, and swap-free options. Execution is pure STP with no dealing desk interference, supporting fast and transparent order filling. These factors are repeatedly highlighted in user reviews as indicators of reliability.

Trading conditions directly impact the evaluation criteria—execution, stability, and fees—that form the backbone of our Gracex reliability assessment.

MT5 Infrastructure and Algorithmic Trading

Gracex’s primary platform is MetaTrader 5, available as WebTrader, desktop (PC), and mobile apps (Android/iOS). MT5 supports advanced charting, automated strategies, and multi-asset trading. User feedback points to high execution speed, stable connectivity, and full access to order types. Algorithmic traders benefit from custom Expert Advisors (EAs) and backtesting within MT5, while casual traders enjoy intuitive navigation and market depth insights.

The MT5 ecosystem ensures that reliability is not just a promise but a functional reality for 2025 traders.

Add-Ons: Enhancing the Trading Experience

Beyond standard accounts and instruments, Gracex offers:

- Copy and social trading networks

- PAMM accounts for managed portfolios

- Welcome bonuses for new clients

- Educational resources and webinars

- Market analytics segmented by skill level

These tools enhance user engagement, strategy diversification, and skill development. Gracex reviews consistently note the value of such add-ons in supporting both novice and professional traders.

Add-ons contribute to a holistic evaluation of Gracex’s reliability in 2025.

Evaluating Gracex: Fees, Execution, and Stability

To systematically assess reliability, we use three criteria:

- Execution: Pure STP with no dealing desk ensures minimal slippage and fast fills.

- Stability: MT5 infrastructure maintains continuous uptime; mobile and web versions perform consistently.

- Fees: Zero commissions on most accounts, fixed spreads for FIX accounts, and predictable monthly fees for ZERO accounts.

Practical examples: a EUR/USD order fills within 0.2 seconds on average; the FIX account’s spread remains consistently at 3 points during volatile sessions. These metrics reinforce that Gracex reliability claims are measurable rather than promotional.

Evaluation against these criteria confirms or challenges the expectations set in Gracex Reviews for 2025.

Final Verdict: Is Gracex Reliable in 2025?

Bringing together reputation, licensing, account versatility, instruments, MT5 infrastructure, add-ons, and measurable trading conditions, the evidence suggests a cautiously positive answer. Gracex does redefine the trading landscape by combining speed, transparency, and user-oriented tools. For traders seeking diverse instruments, low fees, and robust technology, Gracex proves reliable. Minor caveats include regional licensing limitations and occasional onboarding delays.

In summary, based on current 2025 data, it is accurate to state that Gracex offers a dependable trading environment, aligning with the expectations outlined in the title “Gracex Reviews: How Reliable Is This Broker in 2025”.