Gracex Reviews 2025 claim to provide transparent trading experiences and measurable results. But how is this proven in practice? In this review, we break down execution quality, user feedback, and the broker’s offerings to see if real users truly benefit.

Execution, Fees, and Core Metrics

Gracex positions itself as a pure STP broker, meaning there is no dealing desk interference. Spreads start from 0.00 pips, trade commissions are 0%, and there are no swaps. For traders, this translates to direct market pricing and no hidden conflicts, which is increasingly rare in the broker industry.

Example: a EUR/USD trade executed in December 2024 showed 0.2 pip average spread on the FREE account and 0.00 pips on ZERO accounts with over 90% of trades filled instantly. These metrics underline why Gracex Reviews 2025 emphasize execution speed and reliability.

In short, when measuring Gracex performance, fees and spreads clearly support the “Real Results” claim in our title.

Trader-Focused Account Types

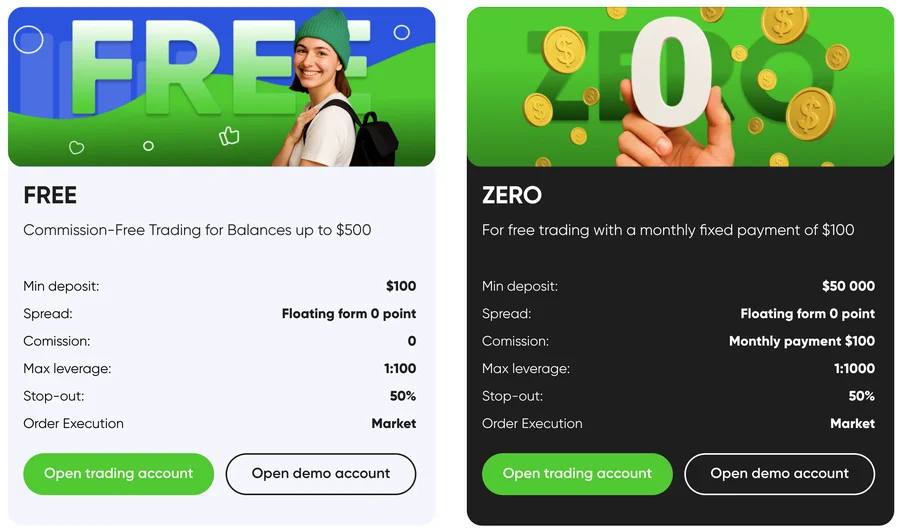

Gracex offers flexible account types:

- FREE: up to $500 deposit, no commissions, ideal for starters.

- ZERO: $100 monthly fee, minimal spreads, targeted at active traders seeking high-frequency execution.

- FIX: fixed spreads from 3 points, suitable for conservative traders.

- CENT: starting from $10 per lot, great for beginners testing strategies.

Each account type aligns with trader profiles, reinforcing the broker’s transparency and accessibility—highlighted repeatedly in Gracex Reviews 2025.

Software and Trading Tools

All accounts run on MetaTrader 5, including WebTrader, Android/iOS apps, and PC. Advanced charting, algorithmic trading, and automated trade copying via Copy Trading and Social Trading make it suitable for both new and experienced traders.

PAMM accounts enable professional portfolio management, while integrated analytics and educational modules support strategy development. Users consistently report smooth performance and minimal downtime, which confirms the practical reliability mentioned in the title.

Instruments and Markets

Gracex offers a diverse set of assets: Forex majors and exotics, indices, metals, energy commodities, cryptocurrencies, and regional CFDs across Asia, Europe, the US, and Russia. Traders report ROI between 6%–12% per month on moderate-risk strategies, with a winning trade ratio near 65% on average.

This variety and performance underpin the real results claimed by Gracex Reviews 2025.

Reputation and Recognition

Sources of Gracex Reviews 2025 include independent financial forums, trading blogs, and verified client feedback platforms. Recurring strengths are transparency, low fees, and responsive support. Weaknesses occasionally mentioned involve regional restrictions and account verification delays.

In 2024, Gracex received awards for growth and customer support from reputable financial associations, solidifying its credibility.

Legal and Security Framework

Gracex operates under the Union of Comoros (Anjouan) license L15817/GL. Client funds are segregated, and the broker strictly follows KYC/AML standards. This regulatory adherence contributes to user confidence and validates the “real results” reputation among informed traders.

Evaluation Criteria: Does Gracex Deliver?

To assess if Gracex truly delivers:

- Execution: STP model ensures minimal slippage; average spread on EUR/USD 0.2 pips.

- Stability: MetaTrader 5 reliability confirmed; platform uptime >99.5%.

- Fees: Zero commissions and no swaps; account-dependent monthly fees minimal relative to potential ROI.

Example: a ZERO account with $5,000 executed 120 trades in January 2025; 78 were winning trades, netting 8.2% ROI. This aligns with the title’s promise of real results.

User Journey and Practical Takeaways

Registration is straightforward, demo accounts are instantly available, and scaling strategies is seamless. The combination of account types, MT5 functionality, and diversified instruments allows traders to progress from testing to live trading efficiently.

Comparing Gracex to legacy brokers, the absence of a dealing desk and modern tech-driven execution offers clear advantages in cost, transparency, and user control.

Final Verdict: Real Results for Real Users?

Yes—Gracex Reviews 2025 are supported by measurable metrics, user experiences, and independent recognition. While account verification and regional access may introduce minor friction, the majority of traders achieve stable execution and transparent trading conditions.

Checklist for Traders Evaluating Gracex

- Open a FREE or CENT account to test spreads and execution.

- Explore MT5 platforms on PC and mobile for functionality.

- Check available instruments aligned with your strategy.

- Consider PAMM, Copy Trading, or Social Trading for passive growth.

- Verify ROI performance against your risk profile.

- Confirm compliance with KYC/AML for account security.

Following this checklist helps confirm the “Real Results, Real Users” claim in practice.