When evaluating a broker, the promise of top-tier service often clashes with reality. In the case of Gracex, the question “How safe is the platform?” deserves a detailed look into accounts, trading conditions, legal status, and technology to separate hype from facts. This review consolidates verified information current for 2025.

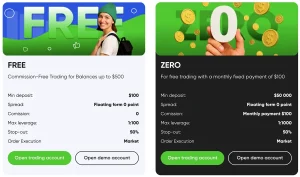

Account Types for Every Trader

Gracex offers four distinct account options designed to accommodate various trading profiles. The FREE account is tailored for beginners, requiring minimal deposit and offering zero trading fees on demo-style trading conditions. The ZERO account targets active traders seeking tight spreads, with entry thresholds starting from $100 and spreads from 0.00 pips with no trade commission. The FIX account provides fixed spreads ideal for planning strategies in volatile markets, and the CENT account allows micro-trading, perfect for testing strategies with real money at very low risk.

Each account is integrated into the MT5 ecosystem, allowing seamless transition between mobile, web, and desktop platforms. From small traders to high-frequency operators, account selection reflects the promise of safe, flexible trading — a core element of Gracex Reviews 2025.

Legal Status and Compliance

Gracex operates under the supervision of the Union of Comoros (Anjouan), holding license L15817/GL. Client funds are kept in segregated accounts with top-tier banks, providing an additional layer of security. The broker strictly adheres to KYC and AML standards, ensuring transparency in client onboarding and ongoing operations. For traders, this means that the platform’s safety claim is not mere marketing but backed by regulatory practices.

Assessing legal security is a key step in determining if the platform truly lives up to the claims found in Gracex Reviews 2025.

Instruments and Market Access

Gracex provides an extensive range of trading instruments. Forex traders can access major and exotic currency pairs, while those focused on broader markets have indices, metals, energy commodities, and cryptocurrencies available. Regional CFDs cover Asia, Europe, the US, and even Russia, offering diversified exposure. This wide asset selection supports both speculative and hedging strategies, and each instrument is traded via STP execution without dealing desk intervention, reducing potential conflicts of interest.

The platform’s instrument variety underscores the practical value highlighted in Gracex Reviews 2025, ensuring traders can operate in multiple markets safely.

Trading Conditions and Execution

Gracex emphasizes cost-effective trading conditions. Spreads start from 0.00 pips with zero commission per trade, and accounts carry zero swap fees, making overnight positions less costly. Execution is purely STP (Straight Through Processing), ensuring market pricing without re-quotes or dealer intervention. These features are particularly relevant for scalpers and algorithmic traders who depend on predictable execution.

Reliable conditions are a cornerstone of platform safety and remain a recurring theme in Gracex Reviews 2025.

MT5 Infrastructure and Software

The broker leverages MetaTrader 5 across WebTrader, Android/iOS, and PC platforms. Speed and stability are emphasized, with advanced charting, algorithmic trading, and back-testing capabilities built in. Whether copying trades, developing EAs, or analyzing multi-timeframe trends, the MT5 ecosystem ensures execution integrity and platform resilience, which is crucial for evaluating Gracex’s safety claims.

Robust software infrastructure repeatedly emerges in user feedback, reinforcing the practical observations in Gracex Reviews 2025.

Services and Additional Features

- Copy Trading: Automatically replicate trades from professional traders.

- Social Trading: Follow and adapt to market trends in real time.

- PAMM Accounts: Invest in professional management strategies.

- Bonuses and Education: Welcome packages, webinars, and analytics enhance trader experience.

Such services align with Gracex’s positioning as a tech-driven broker prioritizing transparency, convenience, and client empowerment — core pillars often cited in Gracex Reviews 2025.

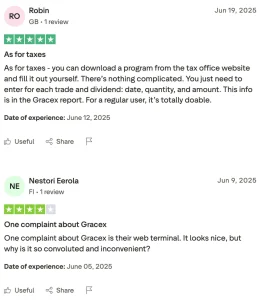

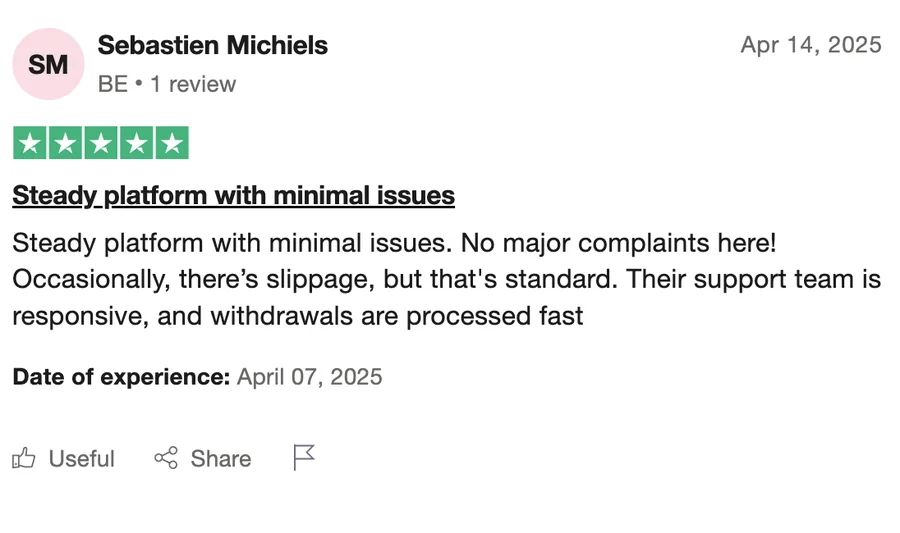

Reputation Breakdown

Online sources, including industry blogs, independent reviews, and social trading communities, reveal recurring strengths: fast execution, low spreads, robust MT5 infrastructure, and responsive support. Weaknesses are minor, often related to regional restrictions or initial account setup times. These insights inform objective evaluation criteria:

- Execution: STP model, zero re-quotes, and stable spreads.

- Stability: Platform uptime, software resilience, and server reliability.

- Fees: Commission-free, zero swaps, competitive spreads.

Using these metrics, Gracex’s reputation aligns closely with its claims, providing a grounded answer in Gracex Reviews 2025.

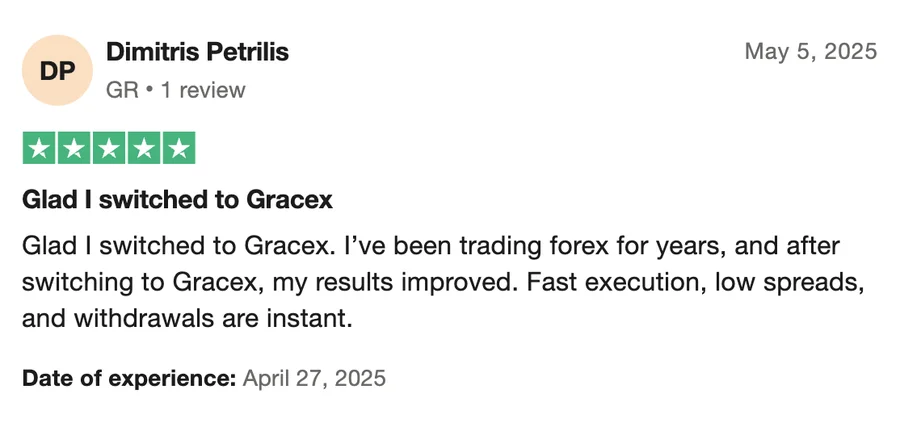

Final Verdict: Is Gracex Safe?

Considering accounts, instruments, regulated status, trading conditions, MT5 infrastructure, and services, Gracex fulfills the core promise of safety and transparency for 2025. Traders benefit from segregated funds, STP execution, and full compliance with KYC/AML standards. While no broker is without minor operational caveats, Gracex’s consistent recognition in 2024 and broad user satisfaction indicate that the platform is generally reliable and secure.

In summary, the title question is answered: yes, Gracex provides a safe, well-regulated environment for trading, backed by technology, diverse accounts, and a broad instrument set — confirming the observations in Gracex Reviews 2025.