When it comes to choosing a broker, ads rarely show the full picture. In this Gracex Reviews 2025 overview, we dive into what truly matters — from account types and software to fees, spreads, and client protections — so you can decide if Gracex is genuinely worth your attention.

Account Lineup and Trading Conditions

Gracex offers a flexible set of accounts tailored for different trader profiles. The FREE account allows beginners to start from $0 up to $500, ideal for testing strategies without risking much. The ZERO account requires $100 per month, offering tighter spreads and low commission fees for active traders. The FIX account starts from 3 points, designed for those preferring predictable costs, while the CENT account begins at $10 per lot, enabling micro-trading for learning or cautious entry. Across accounts, commission structures vary from zero to fixed fees, and minimum deposits are clearly defined, making it easy to choose an account that aligns with your strategy.

These account types illustrate why Gracex Reviews 2025 consistently highlight the broker’s adaptability for traders with different risk profiles.

Regulation and Client Safety

Gracex operates under GRACEXFX Ltd with license L15817/GL from the Union of Comoros (Anjouan). Despite being offshore, the broker implements international KYC/AML standards and maintains client fund segregation. This regulatory framework provides a baseline protection, ensuring that funds are isolated from company operations. While offshore licenses differ from EU or US regulations, adherence to compliance norms is emphasized in Gracex Reviews 2025.

Software Platforms: MT5 Across Devices

Traders gain full access to MetaTrader 5 across WebTrader, PC, and Android/iOS apps. MT5 supports algorithmic trading, advanced charting, and multiple order types, allowing both manual and automated strategies. Portfolio managers and hobbyists alike benefit from the platform’s analytics, while execution speed is maintained through direct STP routing. Gracex Reviews 2025 often note that this tech-first approach differentiates the broker from less versatile competitors.

Assets and Markets

Gracex provides a broad spectrum of assets. Available markets include FX pairs, indices, metals, energy instruments, cryptocurrencies, and geographically diverse CFDs. This variety enables diversified trading strategies and portfolio management, ensuring that traders are not limited to a single asset class. According to recent user reviews, the range of instruments is one of the recurring strengths in Gracex Reviews 2025.

Broker Profile: Who Gracex Is

Positioned as a modern broker, Gracex emphasizes open trading conditions, technology-driven solutions, and practical usability. It aims to move traders away from legacy models with excessive fees and opaque execution. The broker’s philosophy is clear: simplify access, reduce conflicts, and maintain transparency, which resonates throughout Gracex Reviews 2025.

Recognition and Awards

In 2024, Gracex received awards for growth and customer support from reputable financial associations. Such recognition reflects operational stability, technical upgrades, and responsive client services. These achievements are frequently cited in Gracex Reviews 2025 as proof of reliability and long-term commitment.

Trading Services: Copy, Social, and PAMM

For traders short on time or experience, Gracex offers Copy Trading to auto-copy successful trades, Social Trading to follow market trends, and PAMM accounts for professional portfolio management. Coupled with welcome bonuses, educational resources, and market analytics, these services are designed to enhance performance without requiring constant manual oversight. Reviewers consistently mention these features in Gracex Reviews 2025 as practical tools for both novice and professional traders.

Key Trading Metrics

- Spreads: from 0.00 pips

- Commissions: 0% trade commission on most accounts

- Swaps: none

- Execution: pure STP model with no dealing desk, eliminating conflicts of interest

By routing trades directly to liquidity providers, Gracex ensures that prices are true market quotes, which positively impacts execution speed and reliability. This model is consistently highlighted in Gracex Reviews 2025 as a core advantage.

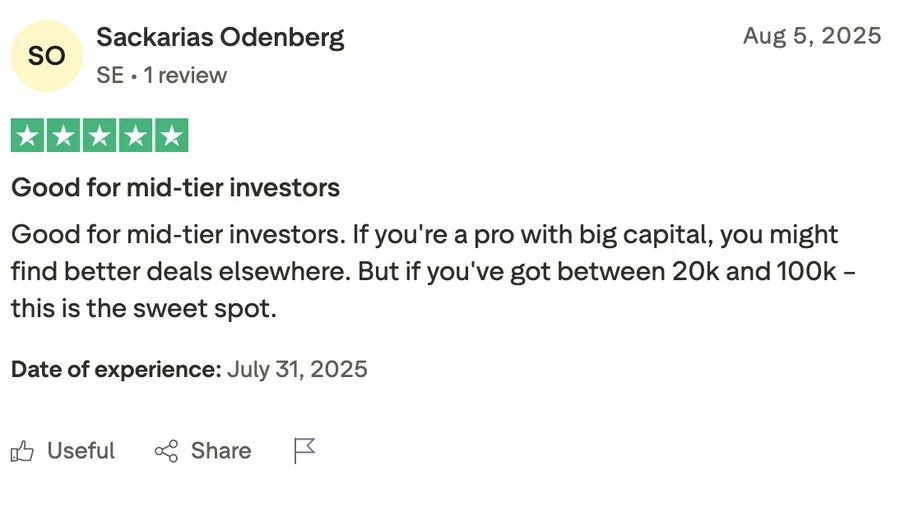

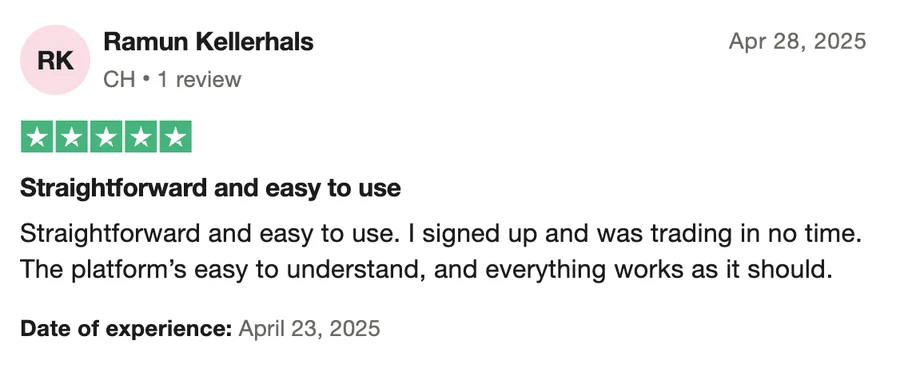

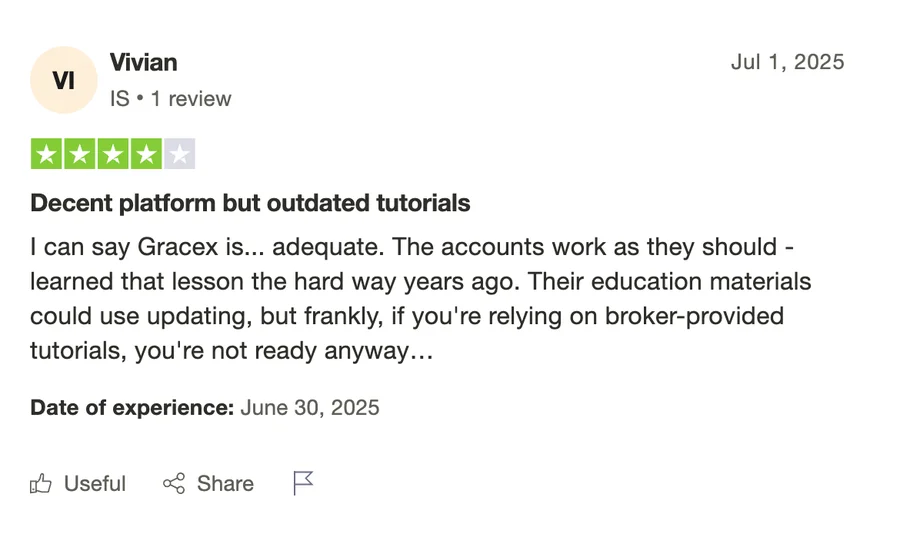

Reputation Breakdown

Review sources include online forums, financial blogs, and independent rating sites. Recurring strengths cited are low spreads, modern platforms, and responsive support. Weaknesses occasionally noted include offshore licensing and limited promotional campaigns compared to larger brokers. Overall, these observations help form an objective picture of Gracex’s credibility and usability in 2025.

Evaluation Criteria: Fees, Execution, and Stability

When assessing Gracex, consider:

- Execution: fast, STP-based with minimal slippage

- Stability: reliable MT5 servers and multi-device connectivity

- Fees: transparent spreads and optional fixed commissions

Practical examples show that a ZERO account trader can enter EUR/USD with 0.0 pips spread and zero commission, while FIX account users prefer predictable costs for long-term planning. This structured evaluation aligns closely with the title inquiry: Gracex Reviews 2025 reveal tangible trading conditions rather than just promotional claims.

Final Verdict: Is Gracex Worth It?

After reviewing accounts, assets, platforms, execution models, services, and user feedback, the answer to “Gracex Reviews 2025: Is This Broker Worth It?” is yes, with conditions. Traders seeking modern tools, flexible account options, and direct STP execution will find Gracex valuable. Those prioritizing strict EU/US regulation may consider the licensing caveat. Overall, the broker presents a transparent, tech-forward alternative in 2025.

Gracex Reviews 2025 confirm that the broker delivers practical advantages without hidden compromises, making it a contender for both novice and professional traders.