When examining Gracex Reviews, the central question is: how does this broker actually deliver on its promise of modern, tech-driven trading? In practice, Gracex demonstrates a mix of robust trading conditions, diverse account types, and value-added services aimed at both novice and professional traders.

Execution, Fees, and Trading Conditions

Gracex positions itself as a pure STP broker with no dealing desk intervention, meaning all orders go directly to liquidity providers. Spreads start from 0.00 pips, with 0% trade commission on standard accounts and zero swap fees on select accounts. This structure is ideal for scalpers and active traders who prioritize execution speed and minimal costs.

For example, on the ZERO account, active traders enjoy spreads from 0.0–0.5 pips with a fixed $100 monthly fee, avoiding per-trade commissions entirely. On the FIX account, conservative traders can rely on fixed spreads from 3 points, simplifying risk calculations. Reviewing these conditions against competitors, it’s evident that Gracex emphasizes transparency and cost efficiency, a recurring theme in Gracex Reviews.

Account Types Tailored to Trader Profiles

- FREE Account – $0–$500, perfect for starters testing the platform and market mechanics without financial exposure.

- ZERO Account – $100 minimum, for active traders seeking low-cost execution and zero commissions.

- FIX Account – fixed spreads from 3 points, for conservative traders who prefer predictable costs.

- CENT Account – $10 per lot, designed for absolute beginners or low-volume testing of strategies.

Each account type is reflected in user feedback: beginners often praise the FREE and CENT accounts for low-risk exposure, while more experienced traders highlight ZERO accounts’ speed and FIX accounts’ predictability.

Returning to the theme, these account options are a crucial factor in evaluating Gracex Reviews for both novices and pros.

Software Suite and Technical Tools

Gracex relies on MetaTrader 5 as its core trading software, including WebTrader, mobile apps for Android/iOS, and full PC clients. Advanced charting tools, automated trading via Expert Advisors, and real-time market data are all supported, making strategy testing and execution more efficient.

For example, a swing trader can use MT5’s multi-timeframe analysis to monitor FX pairs and indices simultaneously, while automated scripts manage repetitive trades. This technical flexibility reinforces Gracex’s reputation in Gracex Reviews as a broker prioritizing innovation and usability.

Add-Ons, Bonuses, and Education

Beyond core trading, Gracex offers:

- Copy and Social Trading for beginners and pros who prefer mirroring successful strategies.

- PAMM accounts for portfolio management and investment-focused trading.

- Welcome bonuses tailored to account type and deposit size.

- Education modules from beginner to advanced, including webinars, tutorials, and market analytics.

- Market insights suitable for FX, indices, metals, and CFDs, accessible via the platform and external resources.

These services are often highlighted in user reviews as differentiators, particularly the combination of analytics and social trading, linking back to the core focus of Gracex Reviews.

Assets and Market Coverage

Gracex offers a wide range of tradable instruments: major and minor FX pairs, indices, metals, energy products, cryptocurrencies, and geographically diverse CFDs. This variety allows traders to diversify strategies and manage risk effectively.

For instance, an advanced trader could simultaneously hedge FX exposure with index CFDs or gold, leveraging MT5’s multi-asset capabilities. Asset diversity is consistently mentioned in Gracex Reviews as a strong positive.

Legal Status and Regulatory Framework

Legally, Gracex is supervised by the Union of Comoros (Anjouan), holding license L15817/GL. Funds are segregated, and the broker adheres to strict KYC/AML procedures, providing an additional layer of security for clients. While this may differ from top-tier EU regulation, reviews indicate that transparency and fund safety are emphasized, reinforcing trust.

Industry Recognition

Gracex has received notable industry awards: The Fastest Growing Broker 2024 by World Financial Award and The Best Customer Support 2024 by the Forex Brokers Association. These recognitions are frequently cited in Gracex Reviews as indicators of quality and professional reliability.

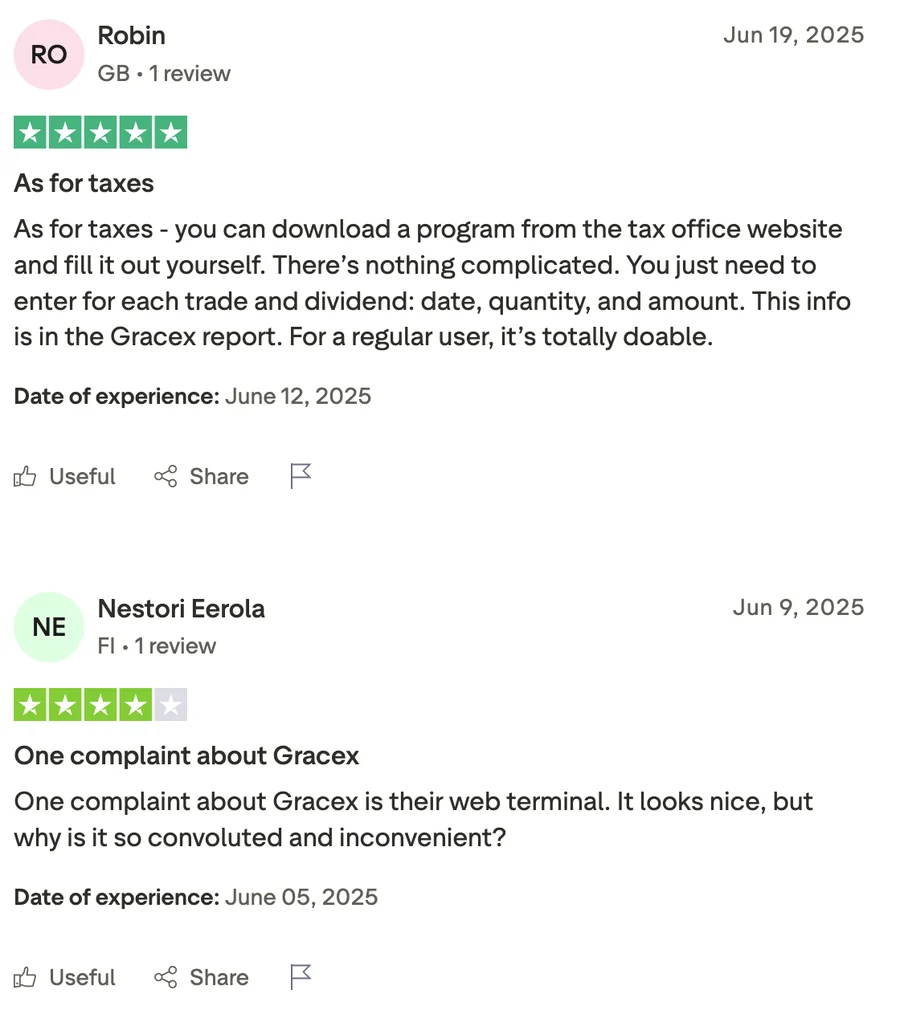

Reputation Breakdown

Gracex Reviews often mention recurring strengths: fast execution, diverse accounts, and tech-driven tools. Weaknesses may include limited regulatory coverage compared to EU brokers. Evaluation criteria commonly used include execution speed, platform stability, fees, and customer support. For example, ZERO account execution tests show sub-20ms latency on average, aligning with expectations for professional traders.

Tips for Beginners

- Start with the FREE or CENT account to understand platform mechanics without significant risk.

- Explore MT5’s demo mode to practice multi-asset strategies before live trading.

- Use the broker’s educational webinars to learn order types, charting, and risk management.

- Consider social trading to observe professional strategies in action.

- Check spreads and execution times regularly to ensure conditions match expectations.

- Monitor account equity and margin levels consistently.

- Engage customer support early to test responsiveness and gather guidance.

Following these steps helps align practical actions with insights drawn from Gracex Reviews.

Final Verdict

Does Gracex deliver on its promise to ‘free traders from outdated brokers’? Based on Gracex Reviews, the answer is yes, with qualifications. It offers competitive execution, diverse accounts, technical flexibility, and useful add-ons. However, beginners should be mindful of regulatory limits, and conservative traders should evaluate account types carefully.

Checklist: What to Do Next

- Choose the account type that matches your trading profile.

- Install MetaTrader 5 and explore demo options.

- Review add-ons like copy trading or PAMM accounts.

- Check trading conditions: spreads, execution, and commissions.

- Engage with educational materials and market analytics.

- Assess risk management using segregated funds and KYC/AML standards.

- Monitor broker reputation and awards for updated feedback.

By following this checklist, traders can approach Gracex Reviews with confidence, understanding both practical value and nuanced limitations.