In this Gracex review, we dive beyond the ads to examine what traders really experience with gracexfx.com. From execution quality to account types, trading instruments, and practical tips, this article explores whether Gracex truly delivers on its promises.

Gracex Overview: Modern Trading, Open Conditions

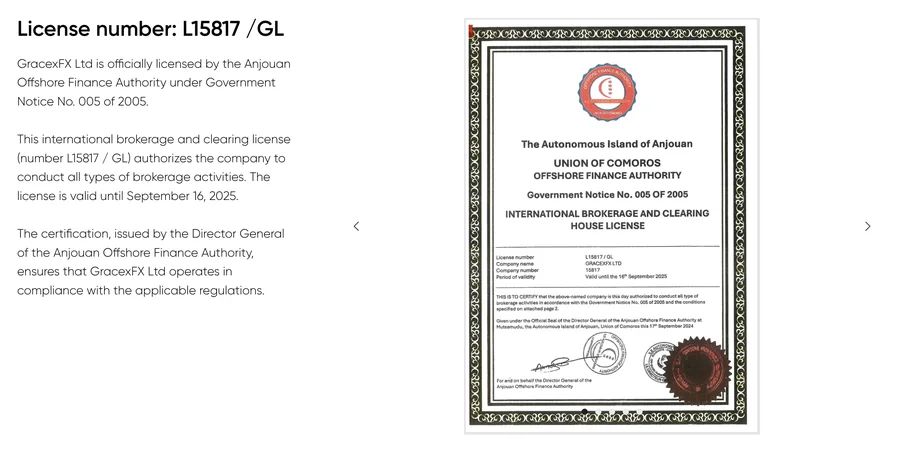

Gracex positions itself as a modern broker that frees traders from outdated trading models. With a strong emphasis on technology, open market conditions, and user-friendly platforms, it targets both beginners and advanced traders. Supervised by the Union of Comoros (Anjouan) under license L15817/GL, Gracex ensures segregated client funds and full compliance with KYC and AML standards, providing a secure legal framework.

As this Gracex review emphasizes, technology and regulation are the foundation for the broker’s practical usability.

Trading Instruments: A Broad Selection for Diverse Strategies

Gracex offers a wide range of instruments, covering:

- Forex majors and exotics

- Indices from Asia, Europe, and the US

- Metals like gold and silver

- Energy commodities including crude oil and natural gas

- Cryptocurrencies and regional CFDs, including Russia

- Stocks, ETFs, and bonds from multiple regions

This broad spectrum allows traders to diversify portfolios and implement complex strategies. According to multiple review sources, users consistently highlight instrument variety as one of Gracex’s strongest points, though some note limited depth in low-volume exotic pairs.

Returning to the theme of this Gracex review, instrument choice is central to executing practical strategies.

Account Types and Conditions

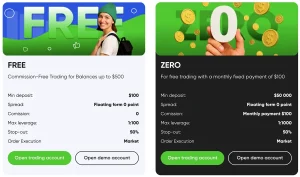

Gracex offers flexible account types tailored to different trading needs:

- FREE: Up to $500 initial deposit, no commissions, zero swaps. Ideal for beginners testing strategies.

- ZERO: Monthly fee of $100, zero spreads from 0.00 pips, zero commission, zero swaps. Designed for active traders.

- FIX: Fixed spreads from 3 points, suitable for those who prefer predictable costs.

- CENT: Starts from $10 per lot, catering to low-budget traders and micro-lot experimentation.

All accounts use pure STP execution with no dealing desk, offering instant fills and zero conflict of interest. Spreads start at 0.00 pips with 0% trade commission and zero swaps, consistently mentioned in reviews as an advantage over traditional brokers.

Evaluating accounts against execution, stability, and fees is essential for any Gracex review to remain practical.

Trading Platforms and Tools

Gracex leverages the MetaTrader 5 infrastructure, available as:

- WebTrader for browser-based trading without software installation

- Android/iOS mobile apps

- PC client for full-featured desktop trading

MT5 supports algorithmic trading, custom indicators, and deep analytics. Users frequently praise speed, stability, and execution reliability. WebTrader, in particular, enables quick access to markets for traders who prefer lightweight solutions. In this Gracex review, platform versatility directly influences strategy implementation and risk management.

Extensions and Additional Services

Beyond standard trading, Gracex provides:

- Social copy trading for mirroring successful strategies

- PAMM account management for investors and professional managers

- Regular bonus offers

- Educational and analytical content, emphasizing automation and efficiency

These services enhance the practical usability of the platform and provide value for both novice and experienced traders. As highlighted in Gracex reviews, such extensions make the broker more than just a trading interface.

Reputation and Recognition

Gracex won awards in 2024 for growth and support from reputable financial associations. Online review sources consistently cite strengths such as execution quality, low costs, and robust platform infrastructure. Recurring weaknesses noted include limited local customer support in some regions and occasional restrictions on exotic CFDs.

Forming an evaluation based on execution, stability, and fees, Gracex performs well in all three, according to aggregated user feedback.

Thus, a thorough Gracex review must weigh both accolades and critiques to provide a balanced perspective.

Practical Tips from Experienced Traders

- Use the WebTrader for quick market access when traveling or using public computers.

- Start with a FREE or CENT account to test strategies without risking large capital.

- Leverage MT5 algorithmic tools for consistent, rules-based trading.

- Diversify across instruments to mitigate regional or sector-specific risks.

- Monitor spreads in real time, especially during major news events, to optimize entries and exits.

Incorporating these tips improves performance while maintaining risk control, a key focus of any reliable Gracex review.

Final Verdict: Is It True That Gracex Lives Up to Its Promises?

After reviewing instruments, account types, execution, platforms, and reputation, the answer is nuanced. For traders seeking modern infrastructure, transparent conditions, and a broad asset range, Gracex generally delivers. While minor limitations exist in exotic liquidity and local support, the overall offering supports effective strategy execution, reliable automation, and portfolio diversification.

In conclusion, Gracex reviews confirm that for most traders, the broker’s claims about technology, execution, and usability are accurate — making it a practical choice for both beginners and experienced market participants.